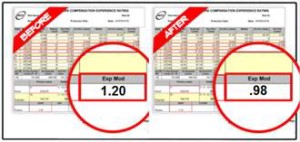

Experts agree that a large percentage of experience modification factors are wrong.

Having an incorrect experience modification factor results in a higher premium, and you could end up paying a lot more than the average employer in your industry.

Having an incorrect experience modification factor results in a higher premium, and you could end up paying a lot more than the average employer in your industry.

It is all too common, especially in the construction, healthcare, manufacturing, staffing, transportation and food industries, that when an insurance company sees a high experience mod, it assumes the operation carries more risk than it actually does. The insurance company, meanwhile, automatically charges unnecessarily for the high mod and takes away or minimizes other premium credits such as rate deviations, discounts, and schedule ratings.

Your company may very well be due a refund from your insurance company if:

- Your Experience Modification is greater than 1.00

- Your Experience Modification is between .60 and .99, but has been rising over the past several years.

- There has been an increase in Experience Modification factor since the policy began.

That is where we come in.

We at APEX Services are trained to see errors and overcharges in experience modification factors, because auditing is all we do.

- We perform an entire compliance audit.

- By the time we’re done, you will have reduced your workers’ comp premiums without skimping on your coverage.

- We will go back and retroactively adjust your current and prior policies to obtain refunds for you.

- When our audit is complete, you will also see savings in future premiums.

If you are paying an annual premium of around $100,000 or more for a guaranteed cost or loss sensitive insurance policy, we will conduct our compliance audit on a contingency-fee basis. You will never pay us for good intentions, ONLY FOR RESULTS.

So don’t keep shelling out money that you don’t have to.